Crypto Coach: How to account for your crypto trades to the tax man

Last Updated on March 12, 2022 by Admin

[ad_1]

Let’s be perfectly clear: Your cryptocurrency is taxable!

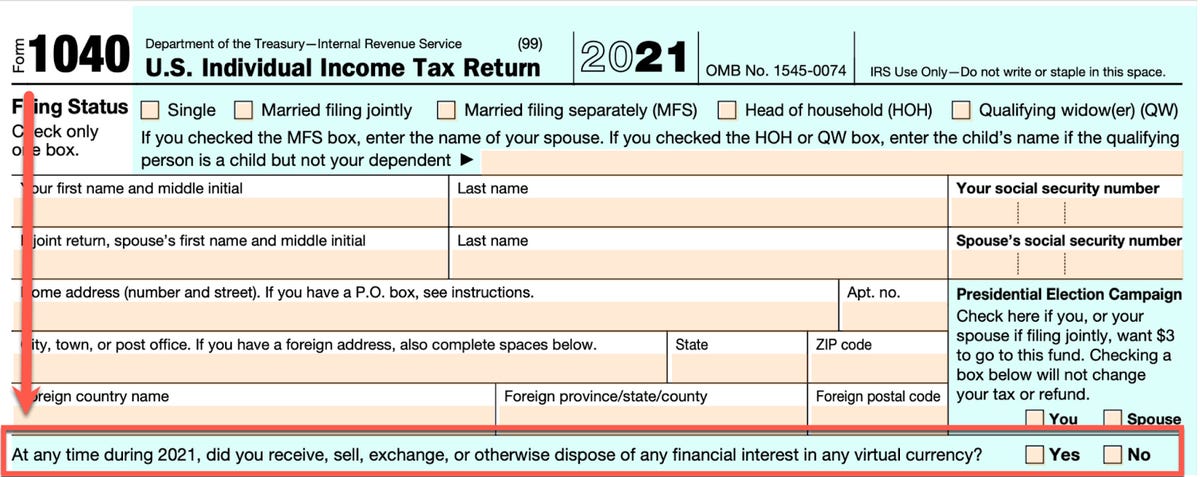

The cryptocurrency marketplace really hit its stride in 2021. It brought more financial institutions and individual investors into buying, holding and selling coins than ever before. For tax year 2021, the IRS wants to know if you held, sold or traded virtual currency (including NFTs); it is a required field to enter. The 2021 Form 1040 includes a required question about cryptocurrency.

Cryptocurrency is treated like property for tax purposes. You have gains and losses on your crypto. Depending on how many trades you did, this can be a daunting task. Some exchanges just send you a Form 1099-B which simply shows your proceeds (buys and sells combined) and requires you to submit a cost basis. If you don’t have this information, you are on the hook.

In the crypto world, if you purchase and hold a virtual coin, you owe zero taxes. For example, I purchased 0.10 Bitcoin in 2021 for $6,000. Bitcoin has a cost basis of 60,000 fiats (or $60,000). If I hold this Bitcoin, or any virtual coin, for all of 2021, and I don’t sell or trade it for another coin, I owe no taxes for 2021. I still have to mark “Yes” in the question above, but I owe no taxes since no taxable event has occurred. I am simply holding the coin. We call this HODL in the crypto world.

Let’s take it a step further now. Let’s say I sell Bitcoin in 2021 and Bitcoin is now valued at $35,000. I sell that 0.10 Bitcoin for $3,500. I sold this Bitcoin for a $2,500 loss. When I do my taxes, I have a documented loss of $2,500.

If Bitcoin happens to shoot up to $100,000 and I sold 0.10 BTC for $10,000, I now have a gain of $4,000. We would owe capital gains taxes on $4,000, not the original $6,000 we purchased Bitcoin with.

I will pause here. I know this is a lot, but I think you get the principle. It’s the same as purchasing stocks, but now here’s where it gets interesting. You also owe taxes on trade-to-trades!

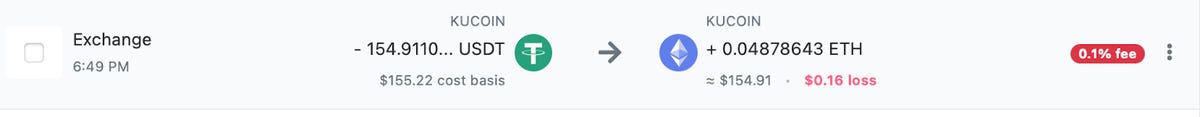

If, for example, you purchase 0.10 Bitcoin for $6,000 (Cost Basis -$60,000 for 1 BTC) and you trade it for Ethereum (ETH), that’s a taxable event. You would be responsible for the capital gains, if any. Here’s an example of a trade I did where my tax software handled it:

I exchanged the stablecoin Tether (USDT) for Ethereum which is a taxable event, but the exchange didn’t incur capital gain, but rather a loss.

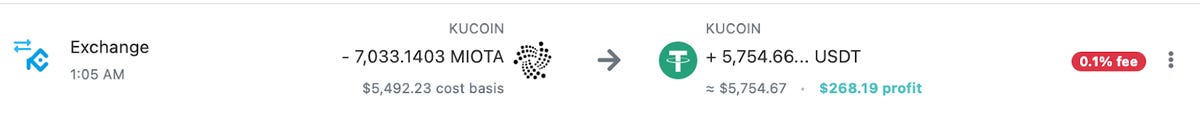

Here is another example:

I exchanged MIOTA (IOTA) for USDT. The exchange is a taxable event. Converting it to USDT was a capital gain on profit of $268.19. Tracking all of this in a spreadsheet would be overwhelming. You could have hundreds of trades in a year, if not thousands.

This is why I use cryptocurrency tax software. There are many you can choose from such as:

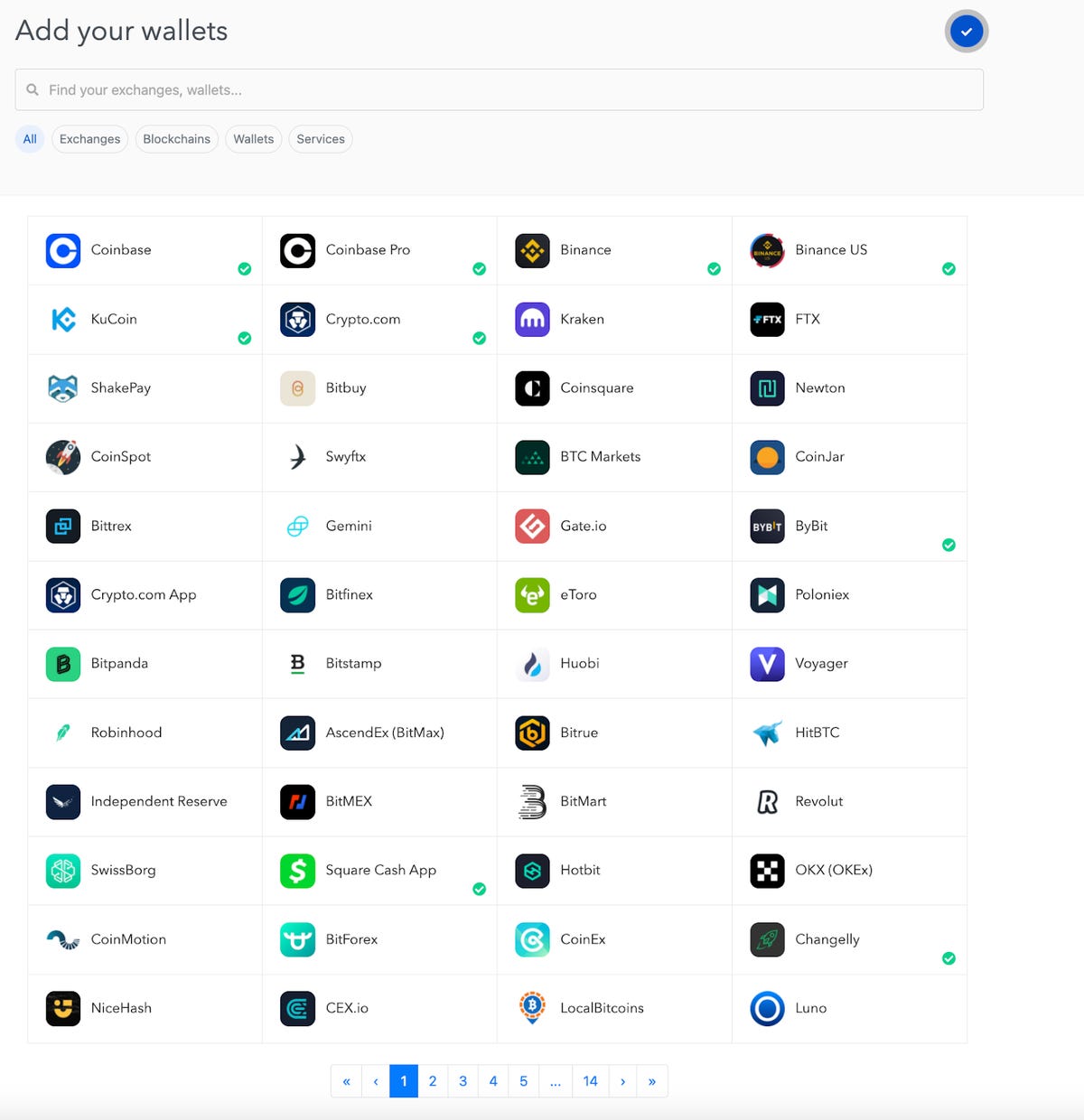

With crypto tax software, you can connect your Exchanges and Wallets to the software and upload all of your transactions. I use Koinly to track all of my trades. I have all of my Exchanges and Wallets connected, which include:

You can connect all of your Exchanges and Wallets (see below). It’s simple to configure. Just choose your exchange and follow the instructions to connect via API or do a CSV upload.

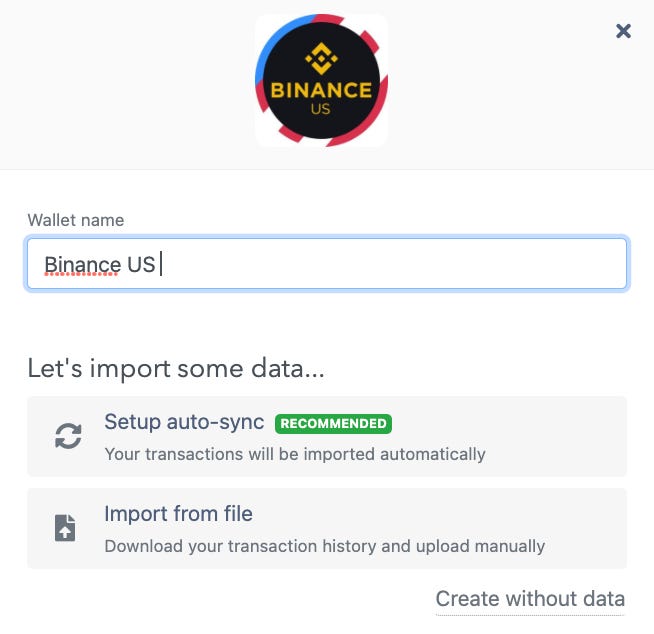

If, for example, you choose, Binance.US, you can choose Auto-Sync or Import from CSV.

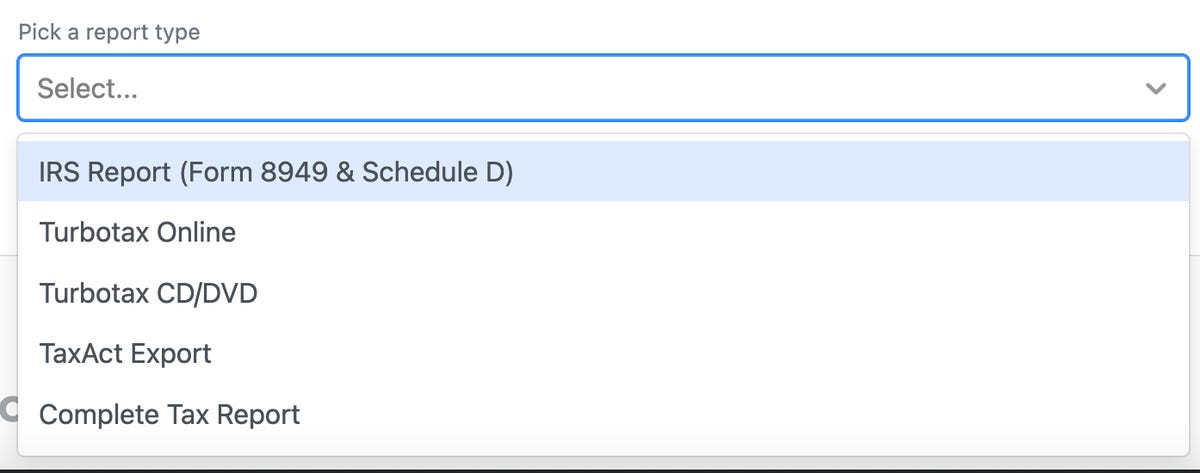

The tax software will calculate your losses and gains and provide all the proper tax reports. It supports a direct upload into Turbotax as well as other options shown below:

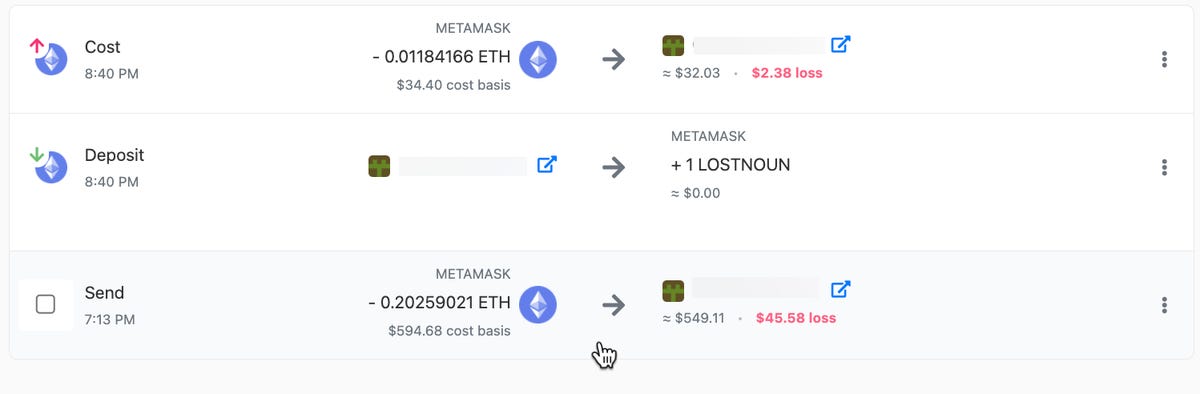

The software also supports the taxes surrounding purchasing NFTs. Buying and Selling NFTs is a taxable event. Here is an example of the tax implication of an NFT I recently purchased:

Let’s break it down. I purchased the NFT with ETH and you can see three trades.

- Purchasing with ETH (cost basis of ETH was higher so I had a loss on the purchase since trade to trades is a taxable event).

- The NFT being deposited to my account is shown.

- Cost – Gas fees

Now when I sell the NFT, if I sell it for a profit, I have the cost basis tracked and I will know what my capital gains tax is. If I sell it for a loss, I will know what my loss is based on a cost basis.

Cryptocurrency goes up and down many times a day. Since trade-to-trades are taxable events, trying to manage everything in a spreadsheet is next to impossible. It’s very important if you are trading or purchasing to have an automated way to track your trades.

Looking forward to our conversations in the comments below.

Acronyms in this column

As promised, here are definitions of the acronyms I used:

Fiat – Currency we typically use to acquire goods and services. Examples include the US dollar, euro and yen.

HODL – Simply a catchphrase. A misspelling of the word HOLD. If you hold a coin through the ups and downs, you are HODLING. Some even say Hold on to Dear Life.

[ad_2]

Source link