US economic growth likely slowed at the end of 2023

Last Updated on January 25, 2024 by Admin

[ad_1]

‘The Claman Countdown’ panelists Simeon Hyman and John Lonski break down the Federal Reserve’s favorite inflation number.

The U.S. economy likely ended 2023 on solid footing, but momentum is expected to have cooled from earlier in the year as consumers battle high inflation and interest rates.

Economists expect the Commerce Department’s first reading of gross domestic product, the broadest measure of goods and services produced in the country, to show the economy expanded by 2% on an annualized basis in the three-month period from October through December.

That would mark a sharp decline from the 4.9% figure reported in the third quarter.

“Incoming data continue to point to a resilient, but cooling, U.S. economy, led by consumer spending on the back of a tight labor market, higher-than-expected holiday spending and moderately strong balance sheets,” Bank of America analysts wrote in a note to clients regarding the upcoming GDP release.

WHEN WILL THE FEDERAL RESERVE START TO CUT INTEREST RATES?

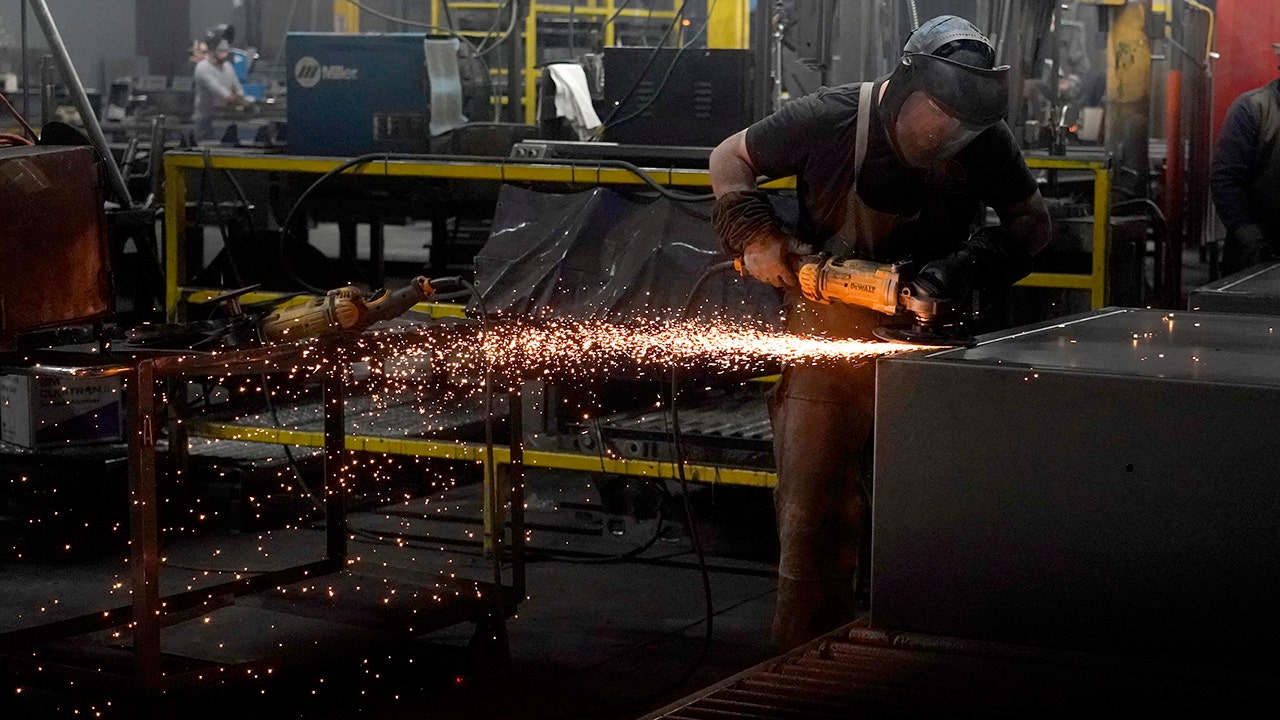

A worker grinds a weld on a safe being manufactured at Liberty Safe Company March 22, 2022, in Payson, Utah. (George Frey/Getty Images / Getty Images)

The Bank of America strategists anticipate that non-consumer spending slowed down from the third quarter with subdued growth in non-residential business fixed investment. Housing also likely posted a “minor increase at best” amid ongoing headwinds from high mortgage rates, low inventory and a lack of affordability.

The economy has proven surprisingly resilient even as the experts predicted the Federal Reserve’s aggressive interest rate hike campaign would send it spiraling into a recession. However, there are signs it is finally beginning to slow in the face of tighter monetary policy.

Job growth is moderating. The housing market, which is vulnerable to higher interest rates, is trapped in a prolonged downturn, and consumer spending has shown signs of cooling off.

THE INFLATION FIGHT FACES A ‘DIFFICULT’ LAST MILE

Many economists expect to see further cooling in coming months as higher interest rates continue to work their way through the economy.

People shop in a grocery store Oct. 12, 2023, in Los Angeles. (Mario Tama/Getty Images / Getty Images)

Steeper borrowing costs tend to create higher rates on consumer and business loans, which slow the economy by forcing employers to cut back on spending.

Yet there is a growing sense of optimism on Wall Street that the Federal Reserve may be able to successfully pull off the elusive soft landing.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bank of America, Goldman Sachs and UBS have raised the odds that the U.S. economy averts a recession and cools without a severe spike in the unemployment rate next year as a result of multiple Fed rate cuts. At their most recent meeting, central bank policymakers penciled in three quarter-point rate cuts in 2024 and lowered their inflation outlook for the year ahead.

“We continue to see a soft landing as the most likely outcome in 2024 even if a collection of headwinds and risks mean that recession odds are around 40%,” said Gregory Daco, EY chief economist. “Consumers will likely remain cautious with their spending as they confront ‘cost fatigue’ and less vibrant labor market conditions.”

[ad_2]

Source link