Oyo files DRHP for $1.2 bn IPO; founder, key investors not diluting stake

The Covid-19 pandemic may have battered the hospitality sector across the globe, but it hasn’t deterred Ritesh Agarwal-led Oravel Stays (Oyo) from going public through an initial public offering (IPO).

The Gurugram-based travel technology company filed the draft red herring prospectus (DRHP) for its Rs 8,430 crore ($1.2 billion) IPO with the Securities and Exchange Board of India (Sebi) on Friday. According to sources, Oyo is looking for a valuation of $11-12 billion.

The company was valued at $9.6 billion after it raised $5 million from Microsoft in August. The offer comprises a fresh issue of equity shares worth Rs 7,000 crore and an offer for sale (OFS) of up to Rs 1,430 crore.

According to the draft papers, investors including Agarwal, Lightspeed Venture Partners, Sequoia Capital, Star Virtue Investment (Didi), Greenoaks Capital, AirBnB, HT Media, and Microsoft will not dilute their shareholding.

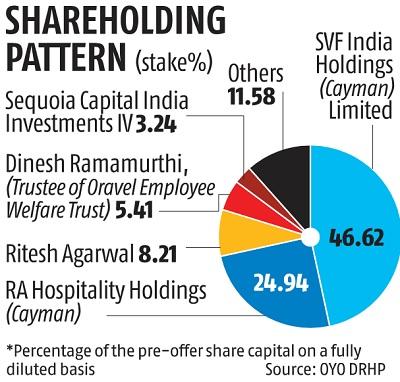

The DRHP names Agarwal, RA Hospitality Holdings (Cayman), and SVF Holdings (Cayman) as the main promoters of Oyo. While Agarwal and RA Hospitality together own 33.15 per cent of the company, SVF Holdings owns 46.62 per cent.

The OFS comprises aggregate shares from a small part of SVF India (Softbank Vision Fund), A1 Holdings (Grab), China Lodging, and Global IVY Ventures LLP.

Agarwal, aged just 27, increased his stake in the company to 30 per cent in 2019 by buying shares from early investors Lightspeed Venture Partners and Sequoia India, which continued to back Oyo.

RA Hospitality Holdings (Cayman) signed a $2 billion primary and secondary management investment round, supported by global institutional banks and Agarwal’s financial partners. A deal such as this, where a founder has brought back stake from early investors before an IPO, has few, if any, parallels.

According to the DRHP, Oyo plans to use the net proceeds to repay the debt availed by some of its subsidiaries, fund organic and inorganic growth initiatives, and for general corporate purposes. It intends to use Rs 2,441 crore for prepayment or repayment, in part, of some borrowings by its subsidiaries and plans to utilise Rs 2,900 crore for funding organic and inorganic growth.

The company and its stakeholders may, in consultation with the lead managers, consider a further issue of equity shares up to Rs 1,400 crore, the documents say.

Financials

Taking the company public has been a tedious affair for the company, which restructured its business in 2019 as it started to slow down after an ambitious expansion plan to enter the international markets.

The company streamlined strategic and shared services, such as revenue management, supply, human resources, legal and finance, from country teams to regional teams to reduce costs.

As a result, its adjusted gross profit margin improved from 9.7 per cent in financial year 2019-20 (FY20) to 33.2 per cent in FY21 along with around 79 per cent reduction in Ebitda losses from FY20 to FY21.

Revenue in FY21 was Rs 4,157 crore, a drop of nearly 70 per cent from the previous year. The restated total comprehensive loss for FY21 net of tax also reduced by 70 per cent to Rs 3,928 crore. Consolidated borrowings were Rs 4,890.6 crore as of July 31.

Over the past year, Oyo has implemented a number of measures as part of its Covid-19 response strategy, including accelerated development and adoption of technology and products to reduce operating costs, and repositioning its offerings. This has also meant a shift in the way it works with the 157,000 hotels and homestays it has tied up with.

In the DRHP, the firm says its app has been downloaded 100 million times and its major focus geographies are India, Malaysia, Indonesia and Europe.

The global coordinators and book-running lead managers to the offer are Kotak Mahindra Capital, JP Morgan India and Citigroup Global Markets India. The book-running lead managers are ICICI Securities, Nomura, JM Financial, and Deutsche Equities India.