Pulling off a massive migration: How Truist Bank devised its “digital straddle”

How do you move 10 million banking customers to an entirely new digital platform, supported by a completely revamped back end? Not all at once. That’s why Truist Bank, formed in 2019 with the merger of BB&T and SunTrust, devised a strategy it calls the “digital straddle” — a way to incrementally introduce customers to a new digital experience before merging and modernizing its backend systems.

“We wanted to figure out a way to bring the merger to our clients faster,” Ken Meyer, Truist Bank’s CIO of the Channel Engineering & Innovation, said to ZDNet, “and not have to have them wait necessarily for these big backend conversions to ultimately start to introduce the brand and what we’re all about.”

Meyer spoke with ZDNet about how the straddle works and why it was the best strategy for the newly-formed bank. Pulling off a massive migration: How Truist Bank devised its “digital straddle”

“Doing big bank conversions of 9 million clients at once, I think, is every contact center and branch’s nightmare when it comes to supporting our clients, so doing it in waves allowed us to learn, and test, and continue to learn from that, and then redeploy.”

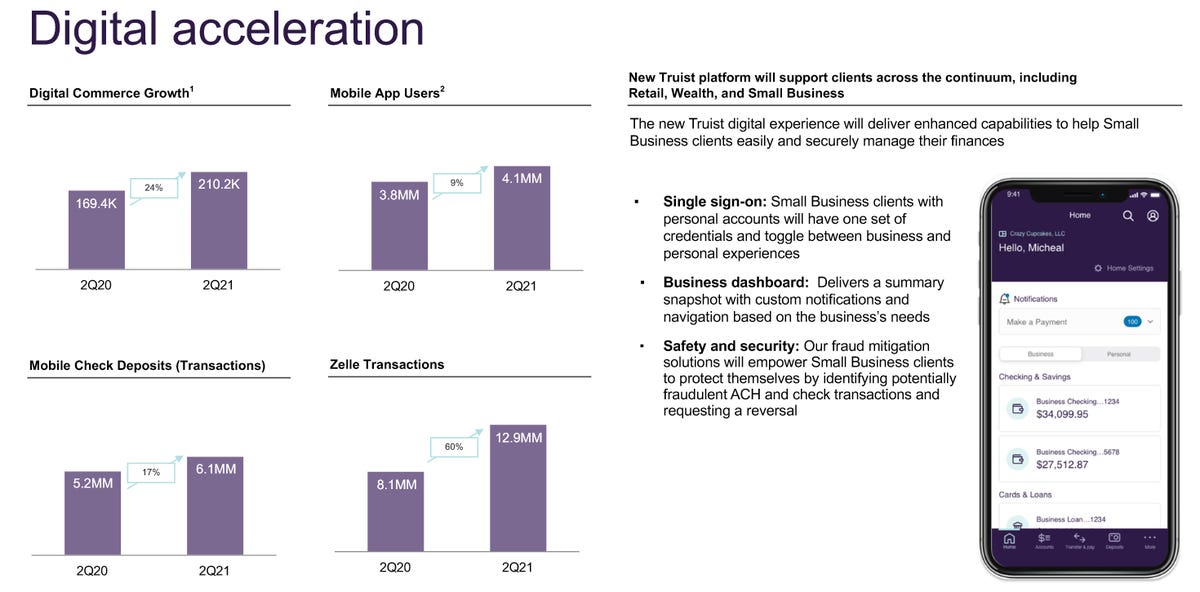

The $66 billion merger created the nation’s sixth-largest bank. And its business is increasingly digital. The company had more than 4 million mobile app users in Q2, up 9% from a year earlier. Its digital commerce — products delivered through digital applications — grew 24%.

Truist Bank

“The reality is that our clients drive what experiences they really want and how they want to engage with us, and I think over the last 10-plus years you’ve seen just a massive rise in digital experiences and the ways that the clients want to be interacting with us.”

Given consumers’ fast-changing preferences, “first and foremost, we really felt like we needed to build a technology platform that would not just allow us to bring all these great features to life for our clients once we’ve consolidated those back ends,” Meyer said. “But we really wanted to create a platform that allows us to be agile in the future and really think about a scalable, secure architecture that’s really modern.

“What the straddle has allowed us to do is actually create a single common user experience layer and user experience API that ultimately sits on top of both heritage backend systems.”

The digital straddle refers to the API layer that sits on top of the legacy infrastructure it inherited from BB&T and SunTrust.

“The magic really happens at that middle tier and the API layer that will allow us, whether you’re a heritage SunTrust or heritage BB&T client, to ultimately authenticate with us and then point to whatever system your accounts are actually being housed on,” Meyer explained.

Truist went live with the first version of its app in March, distributing it internally to employees. The company started bringing clients on in June, with larger conversions starting in July. Now, around 6 million clients have been migrated onto the new platforms with Truist accomplishing about two waves of clients a week. It should have around 9 million customers on the new platform by the end of the year.