ACCC wants all Android devices to have dedicated screen for choosing search engines

Image: Getty Images

The Australian Competition and Consumer Commission (ACCC) has reiterated its call for Google to implement a mandatory search engine “choice screen” after finding the company’s dominance in the online search market has harmed competition and consumers.

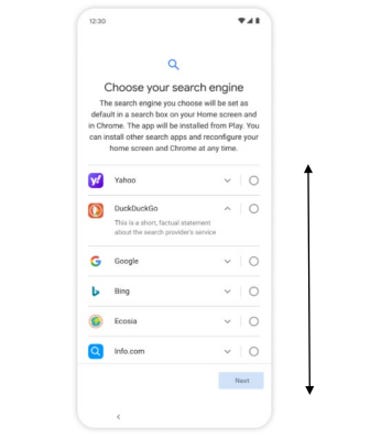

A choice screen is a setup page that presents consumers with a selection of search engines to use, rather than sending consumers to a preset default search engine.

“Choice screens can give consumers the opportunity to make an informed choice about the search engine they use. Choice screens can also help reduce barriers to expansion for competitors to Google, who may offer consumers more options for alternative search engines around issues like privacy and how personal data is collected and used,” ACCC chair Rod Sims said.

The call was made as part of the competition watchdog’s third interim report [PDF] for its five-year Digital Platforms Inquiry, which specifically looked at the market dominance of Google Search.

In the interim report, the ACCC said Google currently owns 94% of the online search market, which was in large part due to Google Search being the preset default search engine for Google Chrome and Apple Safari. Chrome and Safari have a combined browser market share of over 80% on desktop devices and almost 90% on mobile devices.

According to the ACCC, Google gains significant value from being the default search engine for Safari, with Google estimated to receive around $8 to $12 billion per year in advertising revenue from being Safari’s default search engine, and Siri and Spotlight’s default provider for search queries on Apple devices.

The watchdog also noted, however, that Google’s royalty payments paid to Mozilla for having Google Search as its default search engine contributed over 90% of Mozilla’s Firefox annual global revenue.

With this market dominance and control of key search access points, the ACCC said there is likely to be less innovative services being developed and such services having limited reach. Examples of this are search engines that emphasise privacy and minimal data collection, such as DuckDuckGo and Brave.

The screen choice concept is not new, as Google implemented the measure two years ago for new Android devices in some European countries to comply with EU rules.

But the ACCC said the EU screen choice measure has had a “limited impact”, both in terms of the level of market concentration and consumer reach, due to the design of the EU Android choice screen and its implementation as the choice screen only applying to new devices.

Example of a choice screen on an Android device.

Image: ACCC

Detailing how the ACCC wants Australia’s version of the choice screen to work, the regulator said the measure should initially apply to new and existing Android mobile devices and across all search access points on these Android mobile devices.

It added that the choice screen measure could also include restricting a provider, which meets pre-defined criteria, from tying or bundling search services with other goods or services.

Other things flagged in the interim report were that less than a third of respondents to the ACCC’s 2021 consumer survey were aware of privacy-focused search engines and mobile browsers, despite 70% of consumers reporting concerns about the collection of data and personal information by browsers and search engines.

The survey also found that 35% of consumers did not know how to change the default browser on their mobile device or were unsure if they knew how to do so. For desktop use, this issue affected one in five consumers.

Last month, the ACCC criticised Google’s ad tech practices, accusing the tech giant of creating “systemic competition concerns” as part of its inquiry into Australia’s ad tech market.

From analysing open display ads — which are online ads except for those shown on a general search engine or classifieds websites traded on open channels — the regulator found Google’s share of impressions for the four main ad tech services used in Australia was between 70-100% and, for those ad tech services where revenue information is available, Google’s share of revenue was between 40-70%.

The ad tech services inquiry was wrapped up after the ACCC made those findings, with the watchdog now considering how to implement broader ad tech changes as part of the Digital Platform Services Inquiry.