Sensex swings over 1,200 pts; rupee weakens to below 75 on Omicron concerns

Last Updated on January 26, 2023 by Admin

[ad_1]

The domestic markets regained some ground on Monday, following their worst decline in seven months, as investors assessed the threat of the new coronavirus variant Omicron. The gains were capped as the impact of the new variant on the economic recovery and central bank policy action remained uncertain.

The rupee, on the other hand, slipped 18 paise to close at a five-week low of 75.07 against the dollar as fresh worries over the new coronavirus variant weighed on already weak investor sentiment. At the interbank foreign exchange market, the local currency opened at 74.84 and witnessed an intraday high of 74.82 and a low of 75.16 against the dollar in a highly volatile trading session.

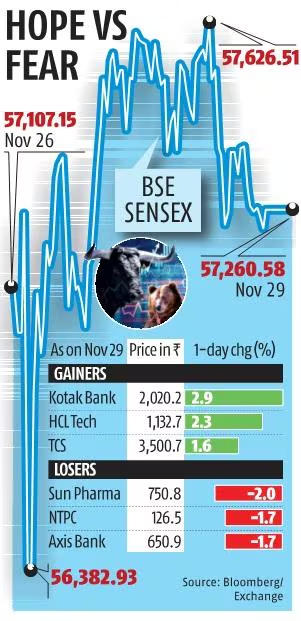

The Sensex, after tumbling as much as 724 points from the previous day’s close in the opening trade, recovered sharply to trade in the green for the most part of the day. Positive global cues helped the market stay in the green albeit marginally. Consistent selling by global funds continued to weigh on performance.

In intraday trade, the Sensex declined to a two-month low of 56,383. The index, however, ended the day at 57,260 with a gain of 153 points, or 0.27 per cent. The index swung nearly 1,243 points during the day.

The 50-share Nifty after dropping to a low of 16,782 managed to close at 17,053.95, with a gain of 27.5 points, or 0.16 per cent. On Friday, both indices dropped close to 3 per cent each following worldwide alert triggered by the new coronavirus variant, Omicron.

Last week, overseas funds dumped stocks worth over Rs 23,000 crore. On Monday, FPIs took out Rs 3,332 crore. Market players say until the selling by foreign funds abates, the market may not climb much higher.

Major markets in the world, too, returned to the green on Monday. Stocks in Europe and US rebounded, along with Treasury yields, as a semblance of calm returned to global markets. In a sign of improved risk appetite, crude oil prices staged a rebound and safe-haven assets, such as gold took a breather. Bitcoin, too, was in the green.

“Investors were torn between buying the dips and uncertainties over the impact of Omicron on economic recovery,” said Vinod Nair, Head of Research at Geojit Financial Services.

The latest bout of selling in the global markets triggered by the Omicron variant came at a time when sentiment towards the domestic markets had already turned weak amid concerns around expensive valuations and earnings growth pressure.

“The new Covid-19 variant adds to uncertainty; we expect more clarity to emerge in the next few weeks as additional data comes out,” said Motilal Oswal Financial Services (MOFSL) analysts Gautam Duggad and Jayant Parasramka in a note.

The benchmark Nifty and the Sensex are down nearly 8 per cent from their peaks hit on October 18.

The correction, MOFSL analysts said, was “led by global factors, such as Fed’s taper announcement, rising bond yields, higher crude oil prices, and strengthening of the dollar. A big fundraise in the primary market also put some pressure on the secondary market.”

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

[ad_2]

Source link